We are proud to announce that after an external audit, the Quality Management System of PMI Industries, Inc. has been assessed and approved by Smithers Quality Assessments, Inc., to the following quality management system standard and requirements: ISO 9001:2015.

This certifies that our Quality Management System is applicable to design, manufacture and distribute offshore, subsea cable hardware assemblies, and provide testing services. Which demonstrates our commitment to our Quality Policy Statement:

PMI Industries, Inc. provides offshore, subsea cable hardware and assemblies that increase efficiency, reduce failures, and improve installation and deployment time. We are committed to meeting customer expectations, and all applicable requirements, through continuous improvement of our processes. Our advantage is delivering quality, on-time and cost-effective products and services.

Since 2017, PMI has partnered with Smithers Quality Assessments, an accredited quality and environmental management systems certification body, to achieve certification.

“This certification reflects our longstanding commitment to quality, continuous improvement, and our customers,” said Bob Centa, President of PMI Industries, Inc. “It demonstrates the significant effort by the PMI team to continue to uphold the ISO standard throughout the company.”

PMI, celebrating a history of 39 years in 2023, is a global leader in engineered solutions for underwater marine cable connectors and terminations, including assemblies and hardware. The solutions that PMI designs, manufactures, and tests are used on cable systems for impact and abrasion protection, to prevent bending and provide strain relief, and for dynamic and static cable protection.

Our products include high-strength cable terminations and gripping products, towed array and seismic survey lead-in and umbilical terminations, and suspension cable assemblies and hardware.

Our engineered subsea cable hardware assemblies are designed for the following:

- US Navy & Defense Contractors

- Oil & Gas

- Marine & Seismic Survey

- Ocean Exploration & Research

- Offshore Wind, Wave, and Tidal

- University and Research Institutes

State-of-the-art facility provides increased production and testing space, improves process flow, and allows for growth of customized cable engineering solutions.

Cleveland, OH, USA, December 15, 2022 – PMI Industries, Inc., a global leader in engineered solutions for underwater marine cable connectors and subsea cable terminations, moves to a new, state-of-the-art facility in January 2023. The move increases production and testing space by more than two-thirds, removes manufacturing constraints, and improves capabilities, resulting in better lead times and inventory control.

“We are excited for the next chapter in PMI’s history with this modernization of our production and office spaces,” said Bob Centa, President. “We are expanding our design, manufacturing, and testing capabilities and expect to dramatically improve our operational efficiencies. The move positions us to grow in the industries we already serve, increase the product and service offerings to our customers, and expand our geographic reach.”

The new facility offers room for a streamlined process flow that will impact many aspects of PMI’s operations, including access to tools and equipment, material handling, and other logistics improvements. Increased space also benefits PMI’s in-house dynamic cable testing and analysis, a value-added step among the capabilities PMI offers. Many at-sea conditions can be simulated by PMI through its testing, which is used to find cable system vulnerabilities or confirm satisfactory performance before the cable is deployed. In-house testing is available as an independent service to third parties, as well as to the industries PMI serves: oil and gas; marine and seismic survey; naval and military; offshore wind, wave, and tidal and sustainable renewable energy; ocean exploration and research; and university and research institutes.

According to Centa, the across-town move will not adversely impact PMI employees, allowing the company to maintain access to its current talent pool and attract new employees to accommodate growth. Additionally, the larger facility, located at 990 Resource Drive, Cleveland, Ohio 44131, U.S.A., offers easy access for delivery and pickup due to its proximity to major highways.

About PMI Industries, Inc.

PMI, celebrating a history of 39 years in 2023, is a global leader in engineered solutions for underwater cable connectors and terminations, including assemblies and hardware. The solutions that PMI designs, manufactures, and tests are used on cable systems for impact and abrasion protection, to prevent bending and provide strain relief, and for dynamic and static cable protection. Its products include high-strength cable terminations and gripping products, towed array and seismic survey lead-in and umbilical terminations, and cable assemblies and hardware. Industries served include: oil and gas; marine and seismic survey; naval and military; offshore wind, wave, and tidal and sustainable renewable energy; ocean exploration and research; and university and research institutes. For additional information, visit www.pmiind.com.

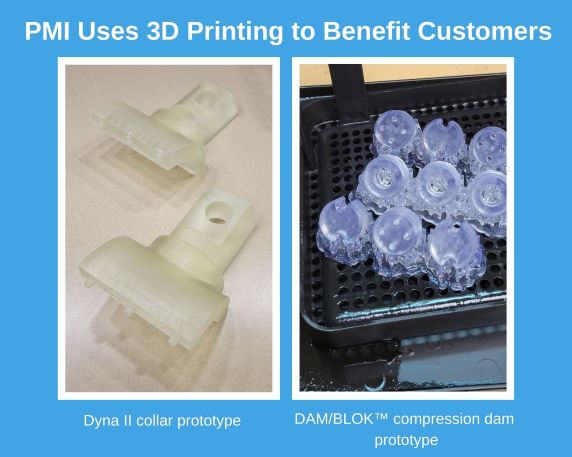

Ongoing improvements in 3D printing are helping PMI explore new ways to provide engineered solutions that meet customer needs. PMI is improving quality control, prototyping crucial components, and experimenting with designs that will reduce assembly time by taking advantage of 3D printing’s additive manufacturing technology.

“The PMI engineering team has used additive manufacturing to make solid three-dimensional objects from a CAD (computer-aided design) file for several years. Because fabrication materials are improving and becoming more cost-effective, we are investigating more ways we can apply the technology,” says Terrence Mathis, PMI Manager, Engineering-Cable Protection.

Engineering team members are managing small projects to improve mold fabrication, potential part casting, compression dam manufacturing, and more.

Analyzing tolerances and variations to improve quality assurance

PMI is using 3D printing to test engineering tolerances of manufactured parts, such as plugs and rings used in a variety of applications. The time needed to measure internal and external features of parts, and ensure their proper fit, can add hours to the quality control process and affect product yields. Also, it can add time-consuming iterations to production if changes occur late in the design cycle.

“Some complex parts have over 20 features that can take four or more hours to inspect,” Mathis says. “Different tools may be needed to measure each section. Depending on the production quantity, it can add a lot of time. Through tolerance optimization, PMI has the potential to improve manufacturing time and reduce cost.”

Prototyping components that customers need to remain operational

PMI is using 3D printing capabilities to prototype crucial components, such as its precision precast compression dams used in DAM/BLOK™ electrical splice kits.

Many of PMI’s field-installable products incorporate helical gripping rods as part of the kit. At times, it is necessary to reterminate a PMI product—sometimes while out on the ocean–to replace helical rods affected by excessive corrosion, or to refurbish the cable connector.

PMI manufactures the DAM/BLOK™ electrical splice kit as a full-ocean depth pressure splice for cable connections. However, there are over 100 existing DAM/BLOK electrical splice kit designs, not including splice kits that can be custom designed for customers. Despite the degree of customization, each kit includes several crucial components, including precision precast compression dams.

Currently, PMI is testing compression dams to ensure it prevents outside seawater as well as leak water within the cable from passing through the splice to the electrical connection. This is especially important at increasing ocean depths.

Developing designs that reduce assembly time

Customers who purchase PMI’s DYNA II cable hangers benefit from its tool-free installation and multiple degrees of freedom, which allow spreader rope loads to pass through with minimal effect on the lead-in and umbilical cables. Like many PMI products, DYNA II can be custom engineered into several configurable kits and accessories.

A collar assembly is just one of the components in a typical DYNA II configuration. PMI is using 3D printing to develop a new standardized collar to be used on legacy and new systems. The prototype collar is 3D printed in a wax resin, which is then cast in stainless steel. The collar serves a build-measure-learn function while saving tooling costs as PMI works to create an improved collar that benefits its customers.

Thinking outside the box to increase development speed

“Our customers turn to us for engineered solutions that include design, fabrication, and testing of subsea tow cables, hardware, assemblies, and protection,” Mathis says. “With a 3D printer, we’re able to take advantage in low-volume situations to revolutionize our development, design and replacement parts in ways that benefit our customers.”

Mr. Centa succeeds Bob Schauer who is retiring after 17 years of service

Cleveland, OH, USA, January 4, 2022 – PMI Industries, Inc., an engineering, manufacturing, and testing company with a global presence servicing energy, both fossil fuel and renewables, marine, research, and government industries announces the appointment of Robert (Bob) J. Centa, MBA to president. Mr. Centa succeeds Bob Schauer who is retiring after 17 years of service to PMI. Mr. Centa was most recently the Chief Financial Officer of The Great Lakes Brewing Co. in Cleveland, Ohio.

“Working at PMI has been truly rewarding and I will miss the daily interactions with the team,” comments Bob Schauer. Mr. Schauer started at PMI with a focus on turning around an underperforming company. As president, he led the company through the oil boom and bust cycles, established an overseas office, all while growing the business during the Covid crisis. “I look forward to spending more time with my family, traveling with my wife, woodworking, volunteering at community organizations, and writing,” comments Mr. Schauer. Speaking on the retirement of Mr. Schauer, PMI Industries board chairman Scott Eucker comments, “The PMI family will miss Mr. Schauer not only from a leadership and inspiration perspective but as a friend. I thank him for all his tireless efforts and wish him joy and happiness in his retirement.”

Mr. Centa brings a broad business acumen and over 25 years of experience in leadership, strategy, operations, and finance in manufacturing and distribution, as well as a wide range of industries and companies as diverse as start-ups, family-owned, private equity, and large publicly traded. Mr. Eucker comments, “I am excited to welcome Bob to the team. His broad business experience and previous leadership roles will be an asset in our company’s growth.” Mr. Centa earned a Master of Business Administration from Cleveland State University and a Bachelor of Business Administration from the University of Cincinnati.

About PMI Industries, Inc.

PMI, celebrating a history of 38 years in 2022, specializes in designing, manufacturing, and testing underwater cable hardware and assemblies. Servicing energy, both fossil fuel and renewables, marine, research, and government industries, PMI builds quality terminations, as well as supplies stoppers and cable grips, umbilical hardware, seismic and cable protection systems. Over many decades we have earned a global reputation for providing the right products at the right time, which ultimately reduces costs by increasing productivity and equipment service life. For additional information, visit www.pmiind.com.

For undergraduates from the Cleveland area, the Emerging Scholars Program offers a path to excellence

In the spring of 2011, a few weeks after he had accepted an offer of admission to Case Western Reserve, Terrence Mathis (CWR ‘16) opened a letter from a faculty member he had never met.

Stephen Haynesworth (GRS ‘87), an associate dean in the College of Arts and Sciences, had written to congratulate Mathis and assure him that he had made the right decision. “When we at CWRU admitted you to the university,” Haynesworth told him, “we demonstrated our respect for your achievements and our confidence that you can succeed here.”

Blog Summary:

- 80% of unexpected challenges and delays in marine projects is cable failure.

- Cable failure creates risks for losing expensive subsea equipment.

- Full-strength underwater cable terminations prevent cable failure during deployment and retrieval of subsea equipment.

- Unlike other helical terminations, PMI’s grips are built to hold your subsea cable to the full-rated breaking strength

- A benefit of the helical wire design permits easy installation of the termination anywhere along the length of the cable and does not require access to the cable end.

- Can be easy installation anywhere along the length of the cable and anywhere in the field.

- Do not require tools or cable preparation.

More subsea projects are happening than ever before, and ROVs, side-scan sonars, and other offshore equipment are almost always an element within them.

When equipment like ROVs and side-scan sonars are deployed or received, the twisting and bending of the cable at the termination point is common. Side-scan sonars and ROVs need these cables to stay intact and be able to bear the weight of the equipment. If these cables can’t keep up, it will cost serious delay and expense to projects.

Cable failure is the cause of 80% of unexpected challenges and delays.

The most common instance happens when subsea equipment is deployed from a vessel or retrieved from the sea and fails due to an extreme amount of tension being placed on the attached subsea cables. If these delicate cables are not terminated properly, they experience damage from strumming and snap loading. At this point, your crew can find themselves spending a good day starting over with installing a brand new termination – costing your project valuable time and money.

Without a proper underwater cable termination or grip, all of the stress and tension is concentrated along the cable where it is attached to the equipment. This is a ton of localized stress on what is usually a very expensive mechanical, electrical, or optical cable. Without a full-rated strength termination, you could be creating a recipe for disaster – cable damage, or worse, a cable break that results in the loss of expensive equipment.

How Helical Terminations Prevent Cable Damage

Helical terminations are designed to function similarly to a Chinese finger trap — a childhood toy that is a woven paper tube letting you place a finger into each end, and then, as you try to pull your fingers out, the tube tightens around your fingers. The harder you try to pull, the tighter the tube grasps your fingers, creating a secure hold.

Helical terminations work the same way. Helical rods are wrapped around the subsea cable at the termination location of the undersea equipment. With a helical termination, all of the stresses that would occur at one localized point on the cable are spread out over the length of the cable wrapped with the helical rods; therefore, greatly reducing the stress on any specific location of the cable.

To be technical, axial loading, a force that passes through the center of an object, causes elongation of the helix (or cable) and results in radial contraction. This compressive force gives the helical rods its ability to hold force. If you hold one end of the helical rod and attempt to pull the cable out, you transfer the load from the cable to the helical rods.

If at any point the load increases, the holding force increases. This mechanism provides a gradual transition of the load from the cable into the helical rod until the helical rods carry the full axial load.

Creating Reliable Attachment Points

A benefit of the helical wire design permits easy installation of the termination anywhere along the length of the cable and does not require access to the cable end. Many times attachment points are needed along the length of the cable. A good example of this is for creating an attachment point for the cable to be lifted from the seabed.

Why PMI’s Helical CABLE-GRIP™ and STOPPER-GRIP™ Terminations are a Preferred Choice

Unlike other helical terminations, PMI’s grips are built to hold your subsea cable to the full-rated breaking strength. When you are working with some of the most advanced and extremely expensive machinery in the industry, you can be confident that PMI’s equipment protects yours better than any cable hardware on the market today.

PMI’s Helical Terminations:

- Generate full-rated breaking strength.

- Permit easy installation anywhere along the length of the cable and anywhere in the field.

- Do not require tools or cable preparation.

- Come furnished in galvanized steel. Other materials, such as stainless steel, are available upon request.

- Work with many jacketed and synthetic strength members.

Invest in your project’s future

PMI’s Cable Grip and Stopper Grip Terminations are an inexpensive investment for preventing damaged cables or replacing a lost piece of expensive robotics. PMI underwater cable terminations have been used on cables for over 50 years, preventing subsea cable damage and maintaining cable integrity.

Check out our Full Rated Strength Terminations:

PMI offers Cable-Grip, Stopper-Grip, and EverGrip Terminations that all utilize Helical Rods.

Not sure what your project needs or have more questions about our helical terminations? Ask one of our experts today to help.

Cleveland, OH— PMI Project Engineer and Marine Energy Specialist Tyler Burger shares his thoughts on the future of cable maintenance and repair in offshore wind farms with Windpower Engineering and Development in the article “The future of cable maintenance and repair in offshore wind farms.”

The third of four Ramform Titan-class vessels, the Ramform Tethys, was celebrated in a naming ceremony at the Mitsubishi Heavy Industries Shipbuilding Co. yard in Nagasaki, Japan today.

PGS’ two first Ramform Titan-class vessels, the Ramform Titan and the Ramform Atlas were delivered in 2013 and 2014 and have delivered beyond expectations on all aspects, especially within safety, efficiency and productivity.

The Ramform Tethys, and the Ramform Hyperion, will be even better due to small modifications of equipment handling on the back deck and an increase in engine power to 26 400 kW from 23 040 kW on the first two Ramform Titan-class vessels.

“With the increased power output and the back deck modifications we are enhancing the Ramform Titan-class acquisition platform further. Productivity, safety, stability and redundancy are the key benefits of these vessels. Their ability to tow many streamers gives high data quality with dense cross-line sampling and cost efficient acquisition with wide tows,” says Per Arild Reksnes, EVP Operations.

The Ramform Tethys is the most powerful and efficient marine seismic acquisition vessel in the world, and along with the Ramform Titan and Ramform Atlas, the widest ships ever at the waterline.

The design dovetails advanced maritime technology to the imaging capabilities of the GeoStreamer® seismic acquisition technology. Her 70 meter broad stern is fully exploited with 24 streamer reels: 16 reels aligned abreast and 8 reels further forward, with capacity for 12 kilometer streamers on each reel. With such capabilities the Ramform Tethys has tremendous flexibility and redundancy for high capacity configurations. Increased work space and advanced equipment handling mean safer and even more robust operations. The Ramform concept design is made by Roar Ramde.

She carries over 6 000 tons of fuel and equipment. She will typically tow a network of several hundred thousand recording sensors over an area greater than 12 square kilometers, equivalent to nearly 1 200 soccer pitches, or 3.5 times Central Park.

For PGS and its clients, more rapid deployment and retrieval of equipment, as well as greater operational capacity will translate into faster completion of surveys and increased uptime in marginal weather. The period between major yard stays is also extended by approximately 50%.

The Ramform Tethys sets the new standard for seismic operations for the next 25 years.

Jon Erik Reinhardsen, President and CEO of PGS states in a comment: “The Ramform Tethys further strengthens our fleet productivity and together with the other Ramform Titan-class vessels will enhance our competitive edge. In the current challenging market environment we also experience more demand for our best capacity and Ramform Tethys will add to PGS ultra-high-end value proposition.”

NOTE: Pictures and more facts on the Ramform Tethys are available on www.pgs.com

For details, contact:

Bård Stenberg, VP IR & Corporate Communications

Mobile: +47 992 45 235

Synthetic cable is stronger than steel on a strength-to-weight basis, which makes it an attractive option in marine environments. The key challenge of synthetic cable is what you do about the attachment points, or terminations.

Terminations can cut the tensile strength of synthetic cable by more than 50 percent, potentially defeating the purpose of going with synthetic to begin with. However, a well-designed and properly installed termination can preserve more than 75 percent of the cable’s strength.

The termination must be installed by the manufacturer of the termination. It can’t be installed like a traditional steel termination can. That means if you’re ordering a volume of synthetic fiber cable, you need to ship it to your cable accessory supplier and have them cut your cable to length and attach the terminations.

Once the termination is in place, it’s there permanently. It cannot be removed. Hence it pays to be careful about your choice of synthetic cable termination provider.

Getting it Right with Synthetic Cable Terminations

Synthetic cables have a vast range of uses in subsea environments. They can do high-tech jobs like protecting fiber optic cables that transmit data around the world. Or they can do more mundane tasks like holding floating platforms in place.

Each of these jobs require terminations and other accessories that are engineered specifically to get the most performance out of the cable and preserve its strength at the attachment point.

At PMI, we’ve worked with clients in the subsea cable sector for decades, so we know exactly how to apply the right termination for each application. We have the specialized equipment required to perform synthetic terminations, and we have people trained to make sure the attachment is done properly.

And, of course, we supply some of the world’s best subsea cable terminations for all these varied applications.

Synthetic cables are less prone to corrosion and much more flexible and easy to use in chaotic marine environments. Many of them even float. But their unique chemical composition requires extra care at the termination point. Ignoring this risk could easily undo your entire investment in synthetic cables.

PMI Industries, Inc. is proud to announce that as of January 16, 2017, it has been ISO 9001: 2015 with Design certified with regard to the design, manufacture and distribution of offshore, subsea cable hardware assemblies and testing services.

PMI is delighted to serve our customers even better through the well-defined and documented processes this certification requires. While PMI has always been committed to quality in its products and services, this certification ensures a more productive environment through faster identification and resolution of quality issues, among many other benefits.

“This certification is a reflection of our longstanding commitment to quality, continuous improvement and our customers,” said Bob Schauer, President of PMI Industries, Inc. “We’re very proud of the dedication put forth by the PMI team.”

PMI partnered with Smithers Quality Assessments, an accredited quality and environmental management systems certification body, to achieve certification.

For more information about PMI Industries’ products and services for offshore oil and gas, please visit pmiind.com, and for more information about PMI Industries’ products and services in offshore renewable energy, please visit powerofpmi.com.